Strategy of Crystal Towards Creating Equal, Fair and Inclusive Economy

Crystal, a financial inclusion organization, functions as a development platform for micro and small entrepreneurs. Established two decades ago in Georgia, the company has since expanded its reach, currently serving over 100,000 customers through a network of over 50 branches across the regions of Georgia. Crystal’s operations involve a workforce of over 1,000 employees.

Maya Kobalia, the Head of the Environmental and Corporate Sustainability Department at Crystal, a pioneer in adopting the UN Global Compact’s Sustainable Development Goals in 2019, discusses the organization’s sustainability vision and priorities.

What financial products and services, designed with social and environmental criteria in mind, does the financial inclusion organization Crystal offer to its users?

Crystal offers a diverse array of financing options geared towards “green goals” in the environmental sector. These range from energy-efficient stoves to hybrid cars, with a significant focus (70% of the green portfolio) on energy-efficient construction materials and equipment. However, equally crucial is our commitment to raising awareness about these environmentally friendly products, which constitutes a key business activity for our company. This emphasis on awareness serves as a starting point. In addition to promoting green products, we consistently provide information to the consumers about the environmental and financial benefits of adopting energy-efficient products for their homes or businesses.

As of September 2023, we have:

⦁ Green portfolio: 16.4 million GEL

⦁ Prevented emission of CO2: more than 2.6 million tons

⦁ Electricity saved: 18 million kilowatt-hours

Regarding the Crystal’s flagship social program, USAID YES-Georgia (“Support to youth and women’s entrepreneurship in Georgia”), implemented in collaboration with USAID and the Crystal Foundation, a total investment of 654,572 GEL was made in youth startups through the Young Entrepreneurs School component from 2016 to 2023. The program’s second and third components, Buzz Georgia and Crystal Consulting, provided motivational and personal development opportunities, financial awareness training, and networking-educational meetings (through various trainings and visits of Buzz Georgia in the cities and villages, networking-educational meetings, sharing of knowledge and experiences) to 4,000 Georgian women entrepreneurs across the country starting in 2020. These initiatives also offered access to small grant projects and business mentorship from Crystal Consulting.

Furthermore, it’s noteworthy that the Crystal gender bonds issued in February 2023 were socially oriented with the specific aim of promoting the empowerment of female entrepreneurs. These bonds were dedicated to financing micro, small, and medium-sized businesses founded by women, contributing to their economic empowerment.

Concerning the gender bonds, as far as we know, Crystal has issued a 25 million GEL gender bond to support women entrepreneurs. Tell us more about the importance of this bond, what role will it play in terms of promoting women’s economic empowerment?

Indeed, in February 2023, Crystal in cooperation with the Asian Development Bank (ADB) issued 25 million GEL corporate bonds as the first certified gender bonds in the country and the region.

Both Crystal and the social framework of the bonds were evaluated by the independent European rating agency SCOPE, which gave the highest rating to Crystal:

This evaluation allowed us to attract more interest from the social impact investors and financial resources loaded with the corresponding responsibility. The social goal of the transaction is to increase access to finance for women entrepreneurs, to finance their micro, small and medium-sized businesses, to promote women’s economic empowerment and gender equality in Georgia.

Crystal issued the bonds with the support of Galt & Taggart, together with the Asian Development Bank and the Bank of Georgia.

What were the challenges of the gender bond release process? Does the process of issuing sustainable bonds in Georgia need to be simplified/improved?

In recent years, the Georgian capital market has experienced increased activity, a trend attributed to the improvements in local legislation and the emergence of relevant issuers. The post-Covid period witnessed notable dynamism, with substantial savings entering the market. The deployment of accumulated capital introduced a fresh dynamic to the capital market, fostering confidence among both the population and companies. The commendable activity of several brokerage firms, characterized by high qualifications, has streamlined the bond issuance process, making it accessible and comprehensible for both issuers and investors.

Regarding gender/sustainable bonds, the issuance process is inherently more intricate, involving additional obligations for the issuer. Throughout this process, a social framework is established through negotiations with both investors and issuers, ensuring that the requirements align with the issuer’s capacity.

Whether the bonds serve a general purpose or a social one, distinct terms and resources are necessary. While the issuance process itself adheres to standard local legislation, the described approach demands additional resources.

Recognizing the challenges, we believe market players involved in sustainable bond issuance should be entitled to the supplementary benefits, including:

⦁ Financing of issue costs, particularly broker fees.

⦁ Grant projects (technical assistance) aimed at enhancing the issuer’s capacity to more effectively achieve social goals.

⦁ Additional incentives from regulators to simplify the emission process.

Tell us about your activities in the regions of Georgia. What is the extent of your support to the private sector in the regions?

Crystal’s 25-year legacy of supporting and collaborating with small and medium-sized entrepreneurs in regional areas is a profound narrative. As of the third quarter of 2023, our user base comprises 114,075 individuals, with 59.2% being women and 40.7% men. We take immense pride in each user, emphasizing their geographical diversity, with 46.8% residing in the regions and 53.2% in the cities. Notably, Crystal operates with up to 50 branches across Georgia, with a significant presence in the regional areas, reflecting our commitment to serving entrepreneurs in these locations. Small and medium-sized entrepreneurs in the regions, who form the backbone of the country, are crucial for development, access to finance, and knowledge.

In 2023, Crystal’s portfolio exceeded 450 million GEL, with over 85% of these funds directed towards financing the endeavors of small and medium-sized entrepreneurs residing in the regions.

Crystal finances micro, small and medium-sized businesses in the regions, what is its strategy in this direction and to what extent does providing such loans contribute to the creation of an equal, fair and inclusive economy?

As is commonly understood, the economies of developed nations hinge on the vitality of micro, small, and medium-sized businesses. Their substantial contributions, such as job creation, tax payments, and thus fostering economic activity in regions.

In Georgia, the entrepreneurial culture is steadily evolving, and financial institutions play a pivotal role in this transformation. Crystal stands out prominently in terms of regional accessibility (as highlighted in the previous response), with dedicated projects and objectives aimed at fostering a fair and inclusive economy.

As of the close of 2023, Crystal has applied for a micro-bank license. We anticipate that this move will also enhance the access to more financial resources for small and medium-sized entrepreneurs.

What are the benefits of introducing sustainable practices directly to micro, small and medium businesses?

Through the implementation of sustainable practices, the company’s portfolio evolves, creating increased opportunities to capture the attention of relevant investors and attract investments. This approach not only stimulates investments of a fitting nature in the country but also aligns with grant and educational programs. These programs prove beneficial not only for the company’s own development but also in terms of providing valuable support to customers.

What is the role of financial institutions in the process of capital market development in the country?

When examining the capital market in Georgia, it’s evident that financial institutions play a pivotal role in its development. On the one hand, as investors, they own significant capital, which is invested in issued bonds; In addition, as issuers, they have created emissions experience. This has become an example for other financial and non-financial companies to explore alternative financing channels.

Financial institutions contribute significantly to diversifying and managing risks associated with investors. Their active participation in the capital market has a profound impact on the market liquidity and efficiency.

Based on the work of the UN Global Compact Network Georgia, we also know that financial institutions play an important role in promoting good corporate governance practices.

In addition, financial institutions in Georgia adhere to the regulatory standards that ensure the integrity and stability of the capital market.

Ultimately, financial institutions are integral to the development of capital markets in terms of providing essential financial infrastructure, intermediary services, and investment opportunities.

What are the efforts of Crystal to raise awareness of economic development and sustainable finance in the community?

Crystal has experienced an exhilarating 25-year journey of growth, development, and continuous learning, paralleling the progress of the country. When I first joined Crystal in 2013, the term and concept of “sustainable financing,” now widely recognized and significant concept, did not exist. At that time, few people comprehended its essence within the global financial sector. Recognizing our responsibility toward the local communities and enterprises, we sought to assist them to the best of our abilities, even before this term gained prominence. It was only later that we formalized these efforts under its own name, driven by a desire to contribute positively at the local level. Over time, our company’s strategy and policies evolved to systematically articulate our non-financial priorities.

It’s crucial to acknowledge that ongoing discussions by the organizations like the UN Global Compact, along with the maturation of the state, non-governmental entities, media, and the financial sector, collectively propelled us to the point where we can now openly discuss and write about sustainable financing. Reflecting on the past decade, this represents a noteworthy and commendable progression.

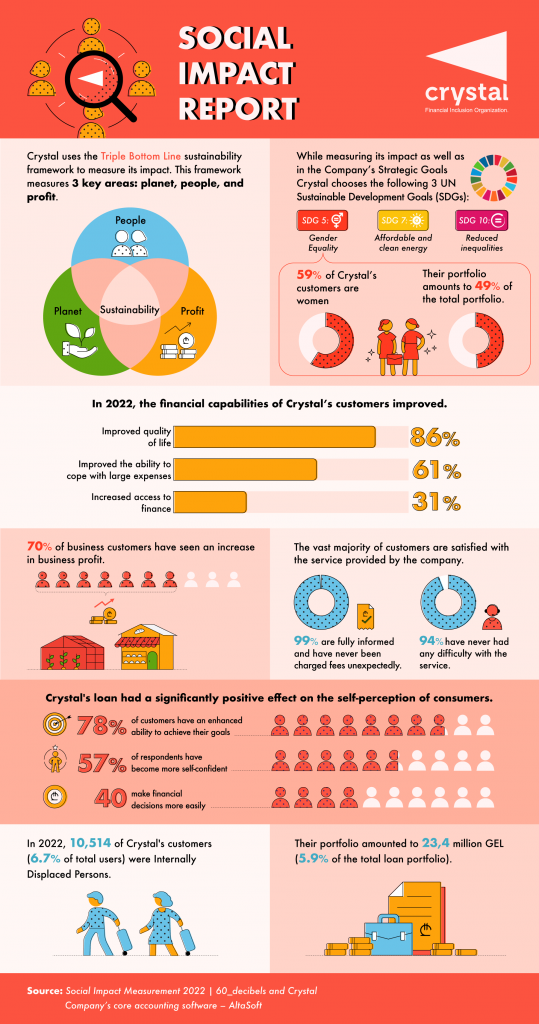

Additionally, based on the findings from our latest Social Impact Measurement, conducted in collaboration with the international research organization “60_decibels,” several notable outcomes emerged. In the period of 2022-2023, the results indicate that 86% of Crystal users experienced an improvement in their quality of life, 61% enhanced their ability to manage significant expenses, 31% saw an improvement in access to finance, and 70% of business users witnessed an increase in profits.

In the context of economic development and sustainable financing for the community, it’s noteworthy to highlight that, in 2022, among the Crystal’s customers, there were 10,514 internally displaced people. Crystal actively collaborates with the UNHCR’s Tbilisi office, extending support to Ukrainian refugees residing in Georgia as part of our ongoing efforts (Infographic prepared by Forset).

For the readers of your magazine, the complete English-language version of the link of the social impact study/report is accessible on the Crystal’s English-language site for the foreign investors and partners: ir.crystal.ge. The Georgian version of the same study can be accessed through this link.

Tell us about your future plans. What are the plans of Crystal to develop the circular economy in the country?

Before delving into the specifics, it might be beneficial to provide your new readers with an understanding of what the circular economy entails. This concept embodies a modern approach to the production and consumption of goods, aiming to minimize waste and optimize the resource utilization.

While Crystal doesn’t manufacture products, it actively contributes to the advancement of the circular economy in the country by financing energy-efficient projects. This not only fosters domestic development but also creates opportunities to attract additional international investments in the environmental sector. Notably, a “green portfolio” was established in Crystal from 2017-2018, aligning with specific social goals and objectives, the key indicators of which were detailed in response to the first question.

The focal points of our future plans revolve around prioritizing women’s economic empowerment, addressing environmental concerns, and sustaining efforts to raise awareness among the Crystal’s extensive workforce of over 1,000 employees and the hundreds of thousands of customers nationwide. Through these endeavors, we aim to continue making a meaningful contribution to the sustainable development of the country.

Search

Search