Synchronizing Sustainable Finance and SDGs: A Mandate for Moving Forward Faster

Author:

Tamar Ghunashvili

Senior Manager, Strategic Communications

UN Global Compact Network Georgia

Sustainable Development Goals (SDGs) and sustainable finance are interconnected through the shared objective of promoting global sustainability.

The UN has estimated that the world will need to spend between $3 trillion and $5 trillion annually to meet the Sustainable Development Goals (SDGs) by 2030, and the COVID-19 pandemic has increased that estimate by an additional $2 trillion annually.

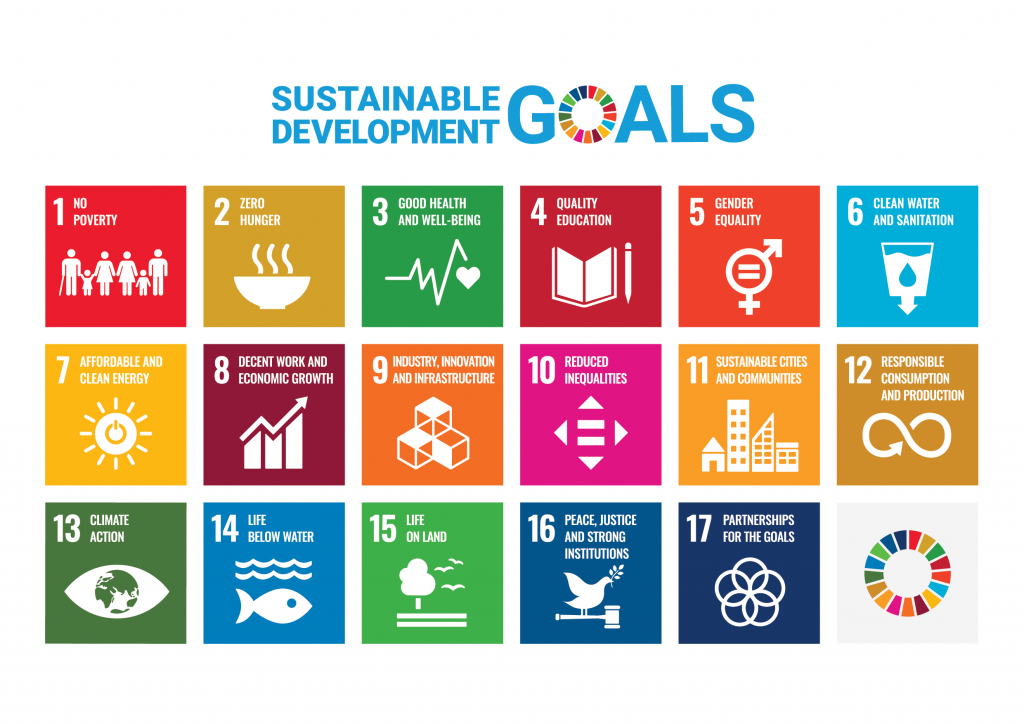

Against the ambitious backdrop of Agenda 2030, where 193 Member States united to create a better future through the formulation of 17 Sustainable Development Goals (SDGs), the importance of sustainable finance becomes pivotal in transforming these aspirations into tangible and impactful outcomes, ensuring that no one is left behind.

There is enormous potential to align corporate investments and finance with the SDGs to finance business contributions towards the SDGs and build on existing sustainable finance solutions and frameworks to support the transition to sustainable development. New and adapted business models and markets represent critical and value-generating investment opportunities for profit and impact.

The UN Global Compact has worked on sustainable finance for the last decade, bringing together companies, investors, and UN agencies. The Financial Innovation Action Platform evolved into the CFO Taskforce in 2019 to establish the groundwork for a broad coalition of CFOs working to harness the full potential of corporate finance to empower the sustainable transition. The initiative has now launched the CFO Coalition for the SDGs.

What is Sustainable Finance? Sustainable finance refers to making environmental, social, and governance (ESG) considerations when making investment decisions in the financial sector, leading to more long-term investments in sustainable economic activities and projects. Environmental concerns include climate change mitigation and adaptation, as well as the environment more broadly, for instance, the preservation of biodiversity, pollution prevention, and the circular economy.

It plays a crucial role in delivering on the objectives of the European Green Deal, which aims to boost the green transition. This means moving towards a green economy through sustainable technology, industry, and transport.

Sustainable finance represents a significant opportunity for financial institutions to reposition their business model in line with customer expectations, evolving economic risks and challenges, and recent ESG and sustainability-aligned requirements and standards driven by politics and society.

The interconnection between SDGs and Sustainable Finance is a priority reflected in various global commitments such as the UN Sustainable Development Goals (UN SDGs), United Nations Global Compact (UNGC), Principles for Responsible Investment (PRI), United Nations Environment Programme Finance Initiative (UNEPFI) Principles for Responsible Banking, Equator Principles, UNEPFI Principles for Sustainable Insurance, Green Bond Principles, etc.

Exploring the Interconnection between Sustainable Development Goals (SDGs) and sustainable finance unveils many interconnected pathways fostering global progress and responsible financial practices.

Sustainable finance is designed to support projects and initiatives that contribute to achieving the SDGs. Mobilizing capital from various sources, including public and private sectors, is crucial to fund projects addressing poverty, inequality, climate change, and other global challenges. Therefore, sustainable finance can help with risk management, considering that financial institutions can better identify and manage long-term risks associated with climate change, social unrest, and other sustainability-related issues by addressing these factors.

Encouraging sustainable development involves fostering the creation and implementation of innovative technologies and solutions, such as investments in renewable energy, clean technologies, and other areas that align with the SDGs, a principle actively promoted by Sustainable Finance.

It also emphasizes measuring and reporting the environmental and social impact of investments. This transparency allows investors to assess the contribution of their portfolios to SDGs and helps track progress toward achieving sustainable development objectives.

The government plays a crucial role as a significant participant in connecting SDGs and sustainable finance. Its pivotal involvement includes promoting sustainable finance by implementing policies and regulations that encourage Environmental, Social, and Governance (ESG) considerations. Furthermore, these policies can align with national strategies to achieve specific SDGs.

Given the critical role of the financial sector in advancing sustainable development, the National Bank of Georgia actively promotes the enhancement of this sector within the country.

The National Bank of Georgia initiated the development of a sustainable financing framework in 2017. In 2019, it released the sustainable financing guide and diligently works to execute the outlined action plan. In August 2022, the National Bank of Georgia published a sustainable finance taxonomy developed in collaboration with local and international experts.

According to the World Economic Forum, despite the recent surge in global demand and supply of sustainable finance, the financing gap for the Sustainable Development Goals (SDGs) has widened, primarily in countries already far behind on the 2030 Agenda.

The push for sustainability has widened global finance disparities. According to the World Economic Forum, in 2022, high-income countries (HICs) controlled 97% of newly established sustainable investment funds, with 80% of global assets under their management. The silver lining? Increased use of innovative financial tools tied to sustainability, like sustainability bonds and debt swaps, could enhance appeal for investors in some developing countries.

In the complex landscape of sustainable finance and its connection to the Sustainable Development Goals (SDGs), a notable challenge emerges—the limited awareness of Environmental, Social, and Governance (ESG) information in developing countries. This knowledge gap poses a significant challenge to seamlessly integrating sustainable practices and global development goals.

Addressing these challenges requires a strategic approach. Integrated national financing frameworks and SDG-aligned strategies are crucial to navigating this complex landscape. These frameworks can serve as guiding principles, helping align the diverse financing needs with the available resources, ultimately fostering a more harmonized and practical approach to sustainable development.

In conclusion, the road to aligning finance and investment with the SDGs demands a revitalized public-private partnership. As mentioned above, Governments play a pivotal role by committing to promoting and facilitating sustainable investments and by championing the integration of these strategies into broader development cooperation initiatives.

By incorporating sustainability principles into financial decision-making, stakeholders can work towards a more inclusive, resilient, and environmentally friendly global economy in line with the objectives set forth by the United Nations through the SDGs.

The following sources were used in the preparation of this article:

https://unglobalcompact.org/sdgs/sustainablefinance

https://www.weforum.org/agenda/2022/05/sustainable-finance-challenges-global-inequality/

https://nbg.gov.ge/en/page/sustainable-finance

https://www.economics-sociology.eu/?955,en_the-role-of-sustainable-finance-in-achieving-sustainable-development-goals

https://www.eib.org/en/stories/what-is-sustainable-finance

https://www.pwc.com/ng/en/services/environmental-social-governance/sustainable-finance.html

https://www.sustainablefinance.ch/en/resources/what-sustainable-finance.html

https://finance.ec.europa.eu/sustainable-finance/overview-sustainable-finance_en

Search

Search